AI-driven supplier intelligence is giving procurement teams the ability to see supply disruptions coming — but only those who move beyond periodic assessments to continuous, predictive monitoring will benefit.

What is Supplier Intelligence?

Supplier intelligence is the structured collection, analysis, and interpretation of supplier-related data — covering financial health, operational capacity, geopolitical exposure, ESG compliance, and market position — to support smarter sourcing, risk management, and supply chain decisions. AI-driven supplier intelligence platforms move beyond static supplier databases to deliver continuous, predictive insight that helps organisations identify risk before it becomes disruption.

In early 2024, a major electronics manufacturer discovered that one of its critical component suppliers had quietly been operating at reduced capacity for three months — the result of a financing crisis that hadn’t shown up in any quarterly business review. By the time the production shortfall hit, the window to diversify sourcing had already closed.

This is the failure mode that supplier intelligence is designed to prevent. Not the disruption itself — some of those are unavoidable — but the loss of lead time that turns a manageable problem into a crisis. In 2026, as supply chains face compounding pressures from geopolitical instability, regulatory change, and ESG scrutiny, the organisations with the most reliable supplier intelligence are consistently the ones with the most options when things go wrong.

Why Is Supplier Risk Monitoring No Longer Optional?

Traditional supplier risk management was built around a reassuring fiction: that an annual risk assessment, combined with a robust approved supplier list, was sufficient to protect supply continuity. For most of the last decade, that assumption held — imperfectly, but well enough.

It no longer holds. The Red Sea shipping crisis of late 2023 disrupted global freight lanes with almost no warning. The 2024 round of US-China trade restrictions created overnight compliance obligations for procurement teams managing electronics and semiconductor supply chains. The EU’s Corporate Sustainability Due Diligence Directive is now creating legal exposure around supplier labour and environmental practices that simply didn’t exist three years ago.

The question is no longer whether your suppliers face risk — they all do. The question is whether you find out about it before or after it affects your operations.

Periodic supplier assessments answer that question too slowly. Real-time supplier risk monitoring — continuous, AI-driven, and covering financial, operational, geopolitical, and ESG dimensions simultaneously — is what closes the gap.

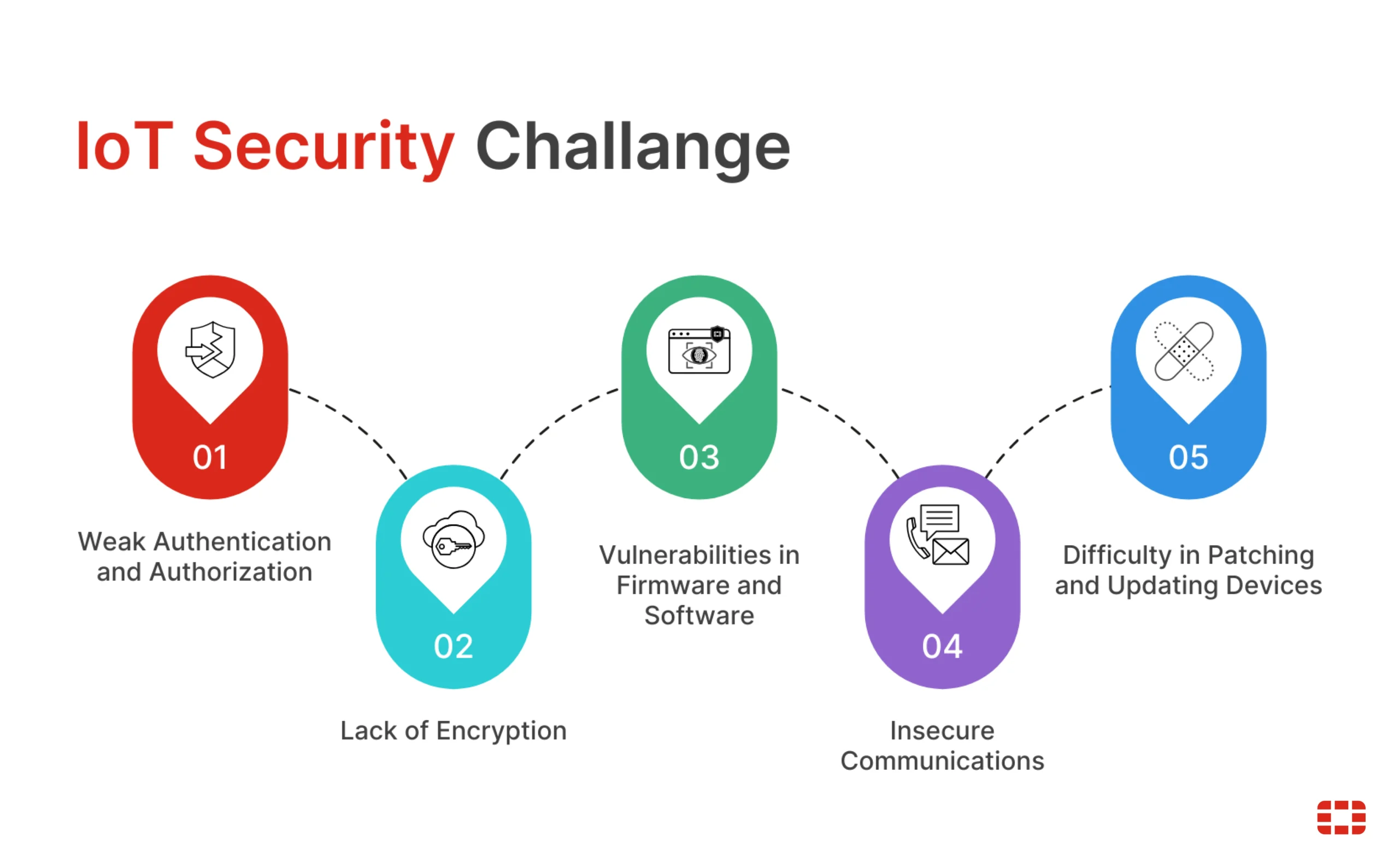

What Does AI-Driven Supplier Intelligence Actually Do?

The term gets applied loosely, so it’s worth being specific about what meaningful supplier intelligence actually delivers.

Financial risk detection

AI models monitor credit ratings, liquidity signals, payment behaviour, and public financial filings across supplier networks — flagging deteriorating financial health weeks or months before it becomes a supply continuity issue. The goal is early warning, not post-event diagnosis.

Geopolitical and regulatory exposure mapping

Supplier intelligence platforms now map not just where your direct suppliers operate, but where their suppliers operate — tracing exposure to sanctions, trade restrictions, and regional instability through multiple tiers of the supply chain. This matters because most supply disruptions don’t originate at tier one.

ESG and compliance monitoring

As regulatory requirements tighten — particularly under the EU CSDDD and equivalent legislation emerging in the UK and US — supplier intelligence is becoming the mechanism through which compliance teams demonstrate due diligence. Continuous ESG monitoring tracks labour practices, environmental violations, and certifications across the supply base in real time, not annually.

Operational capacity signals

Beyond financial and compliance risk, supplier intelligence tracks operational indicators — production capacity utilisation, quality performance trends, lead time variability — that predict delivery risk before it shows up in a missed shipment.

How Should Organisations Build a Supplier Intelligence Capability?

Technology is necessary but not sufficient. The organisations getting the most from supplier intelligence investments share three characteristics beyond platform selection.

First, they have defined what risk actually means for their supply base — not in generic terms, but specifically: which suppliers are critical, what failure modes matter most, and what lead time they need to respond effectively. Without this clarity, even good platforms generate misdirected attention.

Second, they have addressed their data foundations. Supplier intelligence platforms are only as good as the supplier master data, contract information, and spend data they connect to. Fragmented ERP systems and inconsistent supplier records are a widespread problem that no platform can fully compensate for.

Third, and most importantly, they have connected insight to decision. Supplier risk signals that reach a risk analyst’s inbox but don’t reach the category manager making sourcing decisions don’t change outcomes. The most effective implementations embed supplier intelligence directly into sourcing workflows, contract reviews, and supplier business reviews — so that intelligence informs decisions at the moment they’re made, not in a separate reporting cycle.

What Does the Future of Supplier Intelligence Look Like?

Supplier intelligence will continue to deepen in two directions. Coverage will extend further into supply chain tiers — moving beyond tier-one supplier monitoring toward genuine multi-tier visibility, where most of the undetected risk currently sits. And the intelligence itself will become more prescriptive, moving from flagging risk to recommending specific mitigation actions — alternative sourcing options, contract clause adjustments, inventory buffer recommendations — based on scenario modelling.

ESG intelligence in particular will become a compliance necessity rather than a differentiator, as reporting obligations under emerging global frameworks create legal exposure around supplier practices that procurement teams currently monitor inconsistently at best.

The organisations that build robust supplier intelligence capabilities now — clean data, capable people, and platforms that filter signal from noise — will be the ones with the most options when the next disruption arrives. And in the current environment, the question isn’t whether it will arrive. It’s whether you’ll see it coming.

Supplier intelligence doesn’t eliminate supply chain risk. It converts surprises into decisions.